Documentation

NOTE: We are working on extended version of this documentation. Please bear with us for the time being.General rules

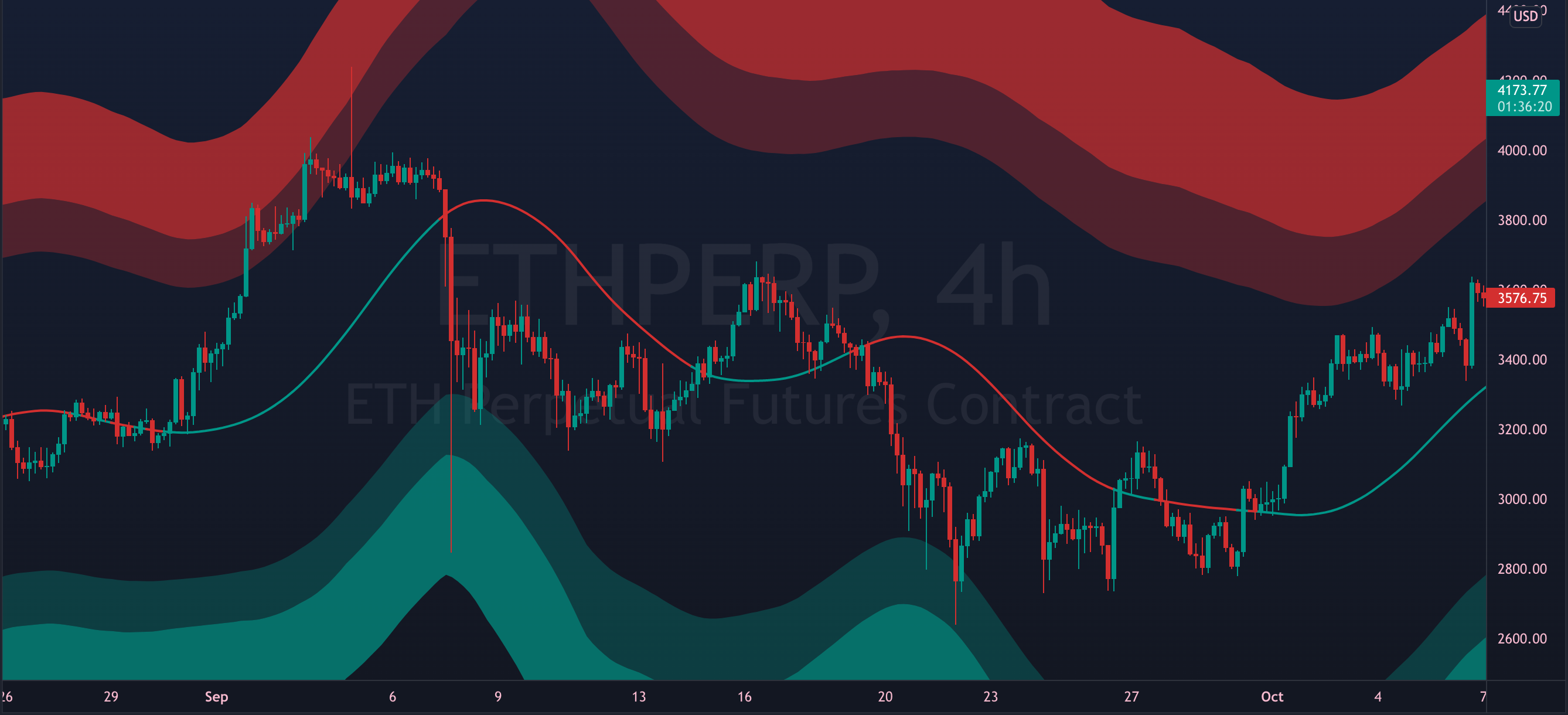

- The clouds represent extreme areas from which price has tendency to bounce off of.

- The mid line can also act as dynamic support/resistance. Flipping it as support can signal bullish continuation. While breaking down from it can signal further decline.

- In non-trending periods, a decent strategy is to long bottom cloud with the mid line as first target and upper cloud as last target, and to short top cloud with the mid line as first target and lower cloud as last target. If the clouds fail to hold, on many occasions it would give chance to exit at breakeven.

Trade fiercely